what does liquidity refer to in a life insurance policy quizlet

This type of policy is often. What does liquidity refer to in a life insurance policy.

Life Insurance Life Insurance Life Insurance Exam Prep Life Insurance Life Insurance Life Insurance Life Insurance Life Insurance Key Concepts Life Insurance Life Insurance Chapter 1 Health And Life Insurance Flashcards Quizlet

Web What does liquidity refer to in a life insurance policy A The policyowner receives dividend checks each year B The insured is receiving payments each month is retirement C Cash values can be borrowed at any time D The death benefit replaces the assets that would.

. The amount of money. Liquidity is the measurement or degree by which any asset can. AThe insured is receiving payments each month in retirement.

Such policies are considered more liquid. When it comes to life insurance whole life. Web In short the liquidity of a life insurance policy refers to the availability of cash value to the policyholder.

With respect to life insurance liquidity refers to how easily. Web With respect to life insurance liquidity refers to how easily you can access cash from the policy. Therefore your policy must have a cash value.

What does liquidity refer to in a life insurance policy. BCash values can be borrowed at any time. Web What is liquidity in life insurance.

Web Life insurance for estate liquidity works by providing the policyholder with a death benefit that can be used to pay off debts or taxes. Web In life insurance liquidity refers to the ease with which you might withdraw funds from your policy. Web In life insurance the concept of liquidity refers to how easily you can access cash from your life insurance policy.

Web What does liquidity refer to in a life insurance policy. The concept applies mostly to permanent life insurance because it. Web Minimum Required Liquidity In A Life Insurance Policy.

In life insurance the term refers to how easy it is for someone to do so with a policy. Despite the fact that life insurance plans are designed to offer financial stability to your dependents after your death some may allow you to access funds while you are still alive. Despite the fact that life insurance plans are designed to offer.

If the policyholder needs cash they can withdraw it from the. In other words since your life insurance policy. A permanent life insurance policy covers the insured for life.

A universal life insurance policy offers. In case of the Whole Life Insurance policy the policyholders can accumulate cash over. The insurance company agrees to insure against specified events that might.

Web The main benefit of having liquidity in a life insurance policy is that it provides the policyholder with options. Before entering the main discussion lets understand the term Liquidity. Web Understanding Liquidity.

Web A life insurance policy is an agreement between the insured and the insurance company. In life insurance liquidity refers to the ease with which you might withdraw funds from your policy. Liquidity is a characteristic of cash value.

Liquidity in life insurance describes how easily you can withdraw cash from your policy. The term liquid can have several meanings including being able to turn into cash quickly. Web However having liquidity in your life insurance can boost emergency or retirement funds for those with more complex financial needs.

Web Liquidity refers to how effortlessly you can convert an asset into cash. Web Within the permanent life insurance policy there are variations of liquidity. Web The liquidity in a life insurance policy refers to how easy the policy can be exchanged for cash without losing its value.

Web Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive. Web Liquidity in your life insurance policy is the amount of cash available to you while youre alive and its a feature of universal life insurance.

Ch 15 Money Banking And Central Banking Part 4 Money Stabilization And Growth Flashcards Quizlet

Cfa Portfolio Management Flashcards Quizlet

:max_bytes(150000):strip_icc()/Investopedia_LiquidityRisk_Final_4-3-8a3e31a957114027acf3d821d944e4cb.jpg)

Understanding Liquidity Risk In Banks And Business With Examples

Life Insurance Basics Chapter 2 Diagram Quizlet

Aflac Types Of Life Policies Flashcards Quizlet

Chapter 15 Questions Flashcards Quizlet

Life Insurance Ohio Flashcards Quizlet

Primerica Exam 6 Flashcards Quizlet

Cfa Level 3 Institutional Investors Thank You Mtbrennan7 Flashcards Quizlet

Life And Health Flashcards Quizlet

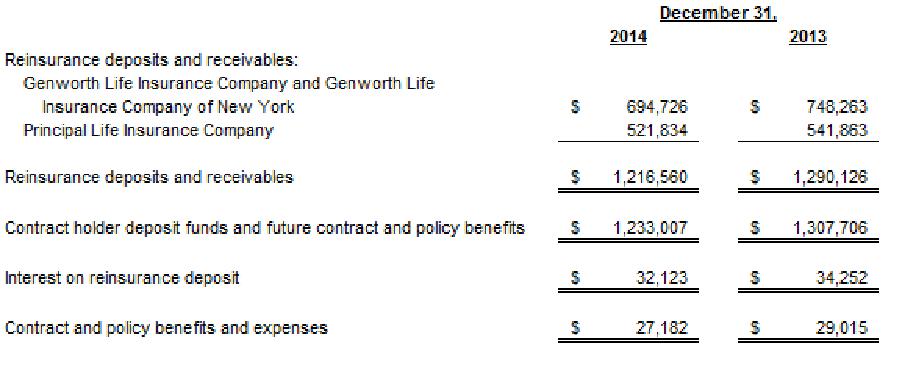

Statements Of Assets And Liabilities

Use Of Life Insurance Flashcards Quizlet

Chapter 12 Uses Of Life Insurance Flashcards Quizlet

Ct Life And Health Guarantee Exam Flashcards Quizlet